Life Assurance Lump Sum

See all the helpful ways this lump sum could be used to safeguard your familys financial security below. The life assurance scheme is non-contributory meaning there is no cost to staff or employers.

What Is Life Insurance Exact Definition Meaning Of Life Insurance

A life assurance lump sum goes to the organisation or one or more persons you nominated to receive it.

Life assurance lump sum. It is a whole of life policy which pays out a cash lump sum. In the event of an NHS staff member dying due to COVID-19 a tax-free lump sum payment of 60000 will be made to their estate or payment made by cheque to the claimant if they meet the qualifying work-related criteria for the scheme. Typically with life cover your family receive the same lump sum if you die during the policy whether thats at the beginning middle or end.

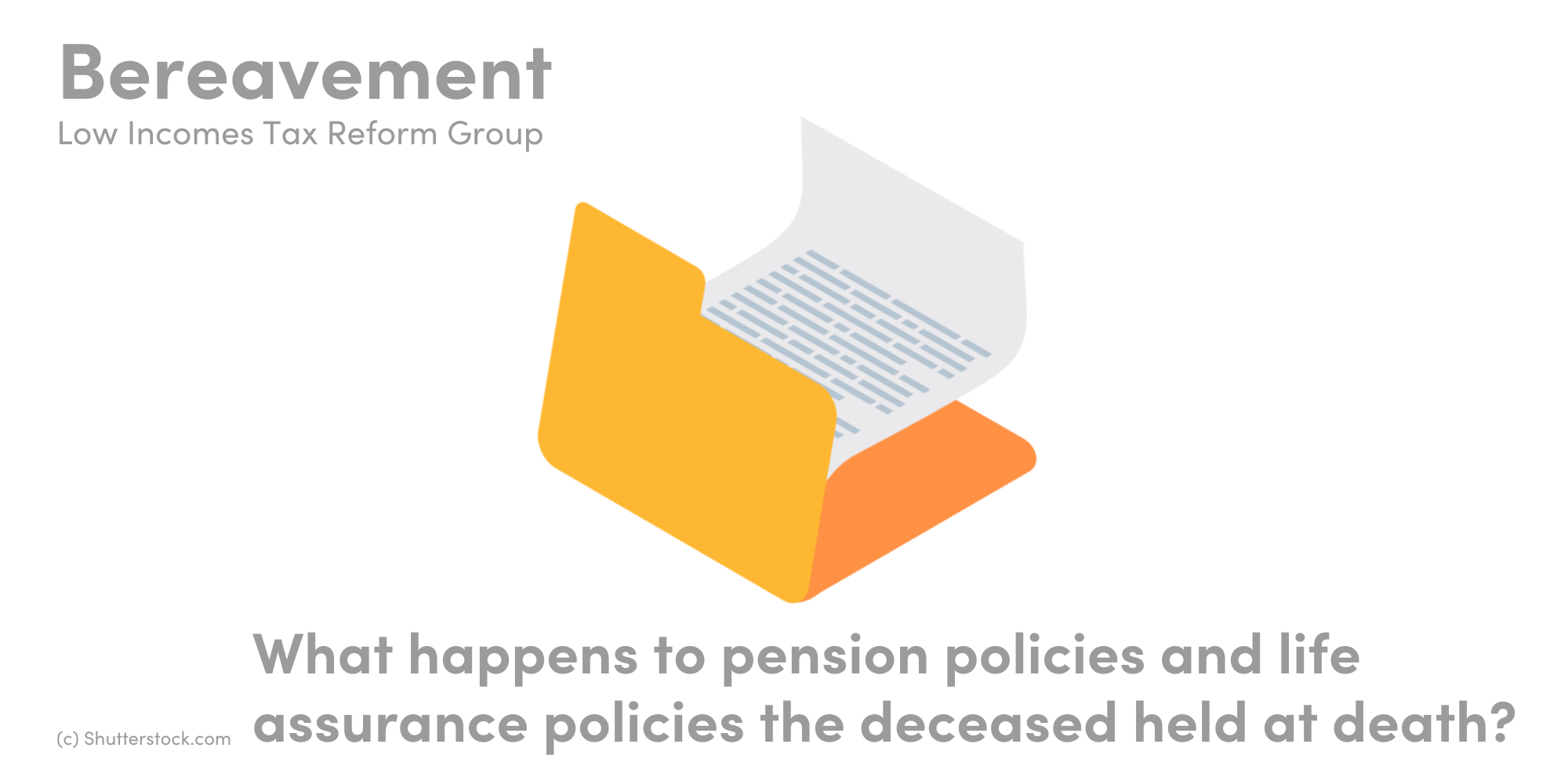

Life assurance cover for retired members. Life Insurance pays out a lump sum when you die which may help your family to continue on without your income. Life assurance is a good choice if you want to make sure your loved ones receive a payout whenever you pass away.

How long you want cover for known as the term. For example if you chose to insure your life for 250000 for the next 25 years then your family would receive the same 250000 if. Our Guaranteed Life Assurance plan offers life cover to anyone who is.

In the event of a staff member dying due to COVID-19 a lump sum payment of 60000 will be made to their estate if they meet the qualifying work-related criteria for the scheme. If youre referring to you receiving a lump sum proceed from a life insurance death benefit the answer is generally no. In such cases the provision of lump sum death benefits can be seen to ancillary and supplemental to the provision of retirement benefits.

Life Assurance benefits when provided through a Registered Trust are considered to be pension benefits. Any lump sum benefit is normally payable outside an employees estate and free from Inheritance Tax liability. Therefore when an employee dies their Registered Life Assurance benefits are added to their pension benefits by HMRC who calculate if the Lifetime Allowance has been exceeded.

The amount of cover you want paid out on your death known as the sum assured or policy benefit. Under this plan apart from receiving some portion of the total sum assured as lump sum the beneficiaries receive the remaining sum assured in monthly instalments with an annual increase of 10 20. This is so whether or not the member takes up that offer.

If there may be eligibility for a claim the employer contacts bereaved families to start the application process. Employers have a key role in the process of submitting a claim for the lump sum payment. We currently offer a life insurance term policy our Life Insurance Plan.

However if youd like to know that a lump sum will be paid out to your loved ones no matter when you pass away you might want to consider a life assurance policy. It does not affect our view if such benefits are increased or reduced. When you pass away if your policy provides a life insurance lump sum payment your beneficiaries would get all.

Cover can be continued up to a certain period when an employee is absent from work due to sickness or taking with an employers consent a sabbatical. More and more life insurance companies are developing preset installment plans that life insurance policy owners can adopt. This could mean having a policy with a 20 or 25 year term.

So say for example that you have a policy with a death benefit of 500000. If you have a young family you may want to put life insurance in place until your youngest child has left school or college. The employer completes preliminary eligibility checks.

A group life assurance scheme can provide peace of mind and reassurance. Life assurance vs life insurance. However most people use life assurance polices for IHT planning both as a means of protecting the policy value from IHT and as a way of giving their beneficiaries a lump sum with which to pay the IHT bill on their estate.

Here we look at some of the. A resident in the UK this does not include the Channel Islands or the Isle of Man. The process of making a claim is outlined below.

The life assurance scheme is non-contributory meaning there is no financial cost to staff or employers. May be payable after death in retirement if you have been in receipt of your pension for less than five years. Group Life Assurance Technical Guide 3 An excellent choice Canada Life Limited aims to satisfy your specific requirements for excepted group life assurance lump sum death in service benefits where the trustees have set up a discretionary trust.

Lump-sum with Increasing Monthly Income. Life assurance and life insurance can both provide valuable peace of mind that your loved ones will receive a lump sum in the event of your death. Depending on the contract other events such as terminal illness or critical illness can also trigger.

Most employers provide some level of life assurance benefit for their employees. These plans differ from the standard lump sum plans by allowing the beneficiaries of a policy to receive the money over a predetermined number of years. Is payable after your death while still an active scheme member.

Between the ages of 50 to 75 years old if you are a smoker. Single-premium life SPL is a type of insurance in which a lump sum of money is paid into the policy in return for a death benefit that is guaranteed until you die. If youre referring to a lump sum surrender of cash values from a life insurance company then there may be an ordinary income taxable event on all gain in the policy.

This is payable in a lump sum if an employee should die and is usually intended to help provide for the employees dependants. The plan helps the beneficiaries in dealing with yearly inflation. A life assurance lump sum is a normally tax free sum of money that.

Any unprotected lump sum pension. Life assurance often known as a whole of life policy is a type of insurance that continues indefinitely and pays out a lump sum once a policyholder dies assuming theyve met their monthly premiums. This can be used either to pay off the mortgage or to cover other essential outgoings - or both.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. A lump sum life insurance payout means the people youve named in your policy to get your death benefit your beneficiaries get that money in one batch. Your premium tends to be higher for this type of life insurance because a.

Increase or reduction in benefits. You will directly benefit from the full support of a dedicated. Between the ages of 50 to 80 years old if you are a non-smoker.

What Is Whole Life Insurance And How Much Does It Cost Unbiased Co Uk

The Endowment Policy Was A Sure Thing The Insurance Pro Blog

What Is A Life Insurance Lump Sum Aviva Ireland

Personal Life Assurance Ppt Download

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

What Is A Life Insurance Lump Sum Aviva Ireland

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Read Our Faqs And Info On Life Insurance Moneysupermarket

Recap Do You Have Any Questions About Efu

What Is A Life Insurance Lump Sum Aviva Ireland

What Is A Whole Of Life Insurance 2021

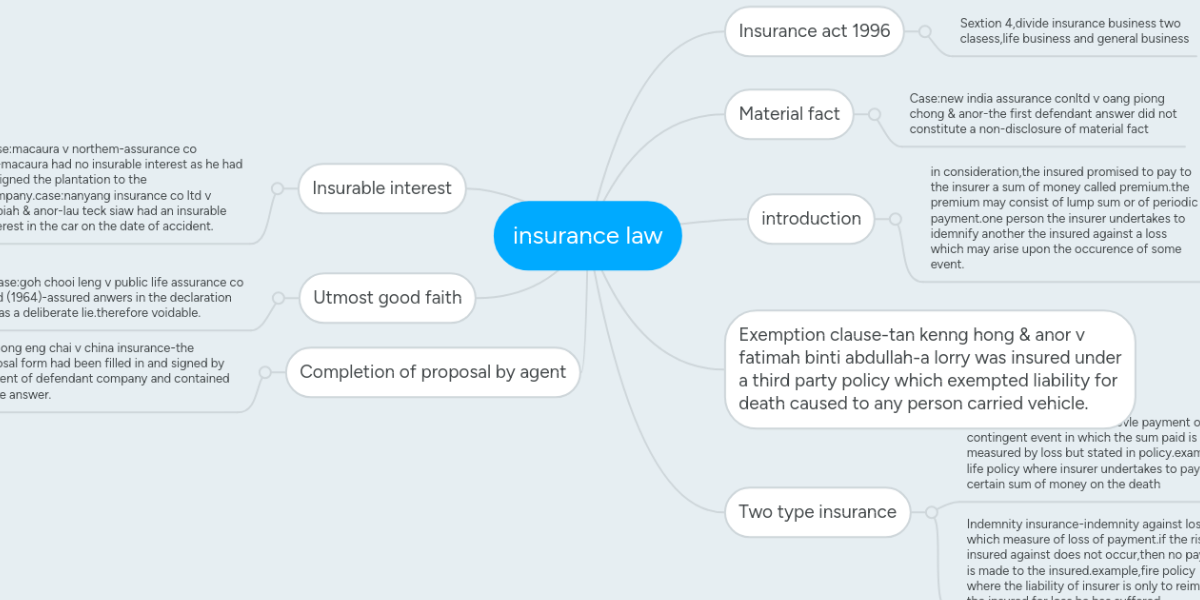

Insurance Law Mindmeister Mind Map

Life Insurance Vs Life Assurance

Posting Komentar untuk "Life Assurance Lump Sum"