What Is Means By Sum Assured In Life Insurance

When you buy a life insurance policy the most important aspect is choosing the sum assured. The sum assured in such plans is expressed as a multiple of the premium amount.

15 Important Terms That You Should Know Before Buying Life Insurance Mymoneysage Blog

Based on that either top up or reduce the Sum Assured.

What is means by sum assured in life insurance. For example when you buy a life insurance policy the insurer guarantees to pay a sum assured to the nominee in case of the insured persons demise. The sum assured depends upon the income of the person and typically a maximum of up to 10 times the annual income is allowed as the sum assured. Your Sum Assured is generally calculated by considering the economic value of your life that may actually go up in time for an individual.

Sum assured is the amount that your beneficiary will get if you die during the policy term. Importance of Appropriate Sum Insured It provides you a sense of security in terms that even if something happens to you today your lifelong savings will not get exhausted over treatment and you will be left with some money to go through your later. Original Total Sum Assured plus any increased Sum Assured purchased by exercising the life stage option prior to 12 months from the date of death due to suicide.

Though a novice might interpret the sum assured and sum insured to mean the same their actual meanings are significantly different. Sum assured is a pre-decided amount that the insurance company pays to the policyholder when the insured event takes place. The sum assured is the amount payable on the occurrence of an event insured against under.

Usually the multiple is expressed as 10 times the premium paid. Sum assured is the fixed amount that an insurance company guarantees to a policyholder or their legal heirs on occurence of the insured event in return for receiving premiums under a life. Meaning pronunciation translations and examples.

Sum assured is the clause generally seen in life insurance policies while sum insured is majorly seen in policies other than life insurance. In fact this amount is the complete coverage of your life insurance policy. The value applicable to non-life insurance policies like car insurance is sum insured.

While for Individual Life they calculate it based on the total premium contribution over the life span of the contract. Plus 80 of the premiums paid for the. However making use of the Human Life Value calculation method isnt difficult.

Guaranteed returns on SBI life insurance is different because the amount is determined by the specific plan chosen by the insurer. A part of the premium you pay is used for the life insurance policy while the rest is used to invest in equity stocks and mutual fundsBut how do you calculate the money your family would receive if you pass away during the policy period or you would receive after the policy. The insurance company pays this money as per the sum chosen by you at the time of purchasing the policy.

This sum payable to the nominee on the happening of the insured event is known as sum assured. My dear SA in Insurance team Amount which has to given by LIC OF INDIA to its clints on Maturity eg if one takes LIC of India policy Jeevan Anand for SA 5000 Lacks terms 2100tearm he she ii get on Maturity after 2100 years get SA Rs 5000Lacks bonus and versted bonus also. Sum insured and sum assured are among the fundamental terms that an individual essentially needs to understand before choosing a life insurance planThe two terms are the basis on which a plan is evaluated.

Your Sum Assured is usually calculated by taking into account the economic value of your life Human Life Value which may actually go up in time for a person. So for this person the sum assured or life insurance coverage needed is Rs 135 crores. Sum insured is the value applicable to non-life insurance policies like car insurance.

Also note that if your family will invest the insurance claim amount then this Sum Assured will reduce. In any case of any eventuality like death the sum assured is the amount that is paid to the beneficiary. In Group Life insurance sum assured is calculated by multiplying the insureds annual emolument by 3.

For instance if you take a policy with a sum assured of Rs30 lakhs your nominee receives the same amount after your. Sum assured is the value of life cover defined under life insurance policies. The sum assured applicable to a life insurance policy is the guaranteed amount your nominee family member receives in the event of your death 2.

Sum insured in insurance is defined by the principle of payment that provides a cover or compensation for damage loss or injury. Sum assured is the coverage the policyholder wishes to have and this is the amount that the bank commits to pay at the end of the policy period or when the person insured passes away. This figure is the guaranteed amount of money that your loved ones will receive in your absence provided all.

If death occurs due to suicide within 12 months from the date of exercising life stage option resulting in the increase in death benefit the death benefit is the aggregate of the following. The value of life cover defined under life insurance policies is sum assured. In other words sum assured is the guaranteed amount the policyholder will receive.

Sum assured is a pre-decided sum that is given to the policyholder in case the insured event occurs. So if you pay an annual premium of INR 10 000 the sum assured would become INR 1 lakh. Sum assured is a pre-defined sum that the insurance company agrees to pay to you or your nominee.

In this TATA AIA blog learn more. What Does Sum Insured Mean. U can find the calculators online to.

The sum assured is the amount of money an insurance policy guarantees to pay up before any bonuses are added. Sum assured is the value of the insurance cover provided at the time of buying the insurance policy. To calculate LIC premium for arrived Sum Assured use this LIC Premium Calculator.

Unit-linked insurance plan ULIP is a product that brings you the best of two worldsinsurance and markets. Sum insured is the amount of money that an insurance company is obligated to cover in the event of a covered loss. Answer 1 of 3.

A sum assured is a fixed amount that is paid to the nominee of the plan in the unfortunate event of the policyholders demise. This term is commonly associated with homeowners or property insurance but can also apply to other types of insurance. The sum insured correlates directly to the amount of premium you pay but not always to the propertys actual value or.

Thus the sum assured and. For instance if you buy a life insurance policy the insurance company guarantees to pay a fixed sum to your nominee in case of your death. Concept of Sum Insured Vs Sum Assured.

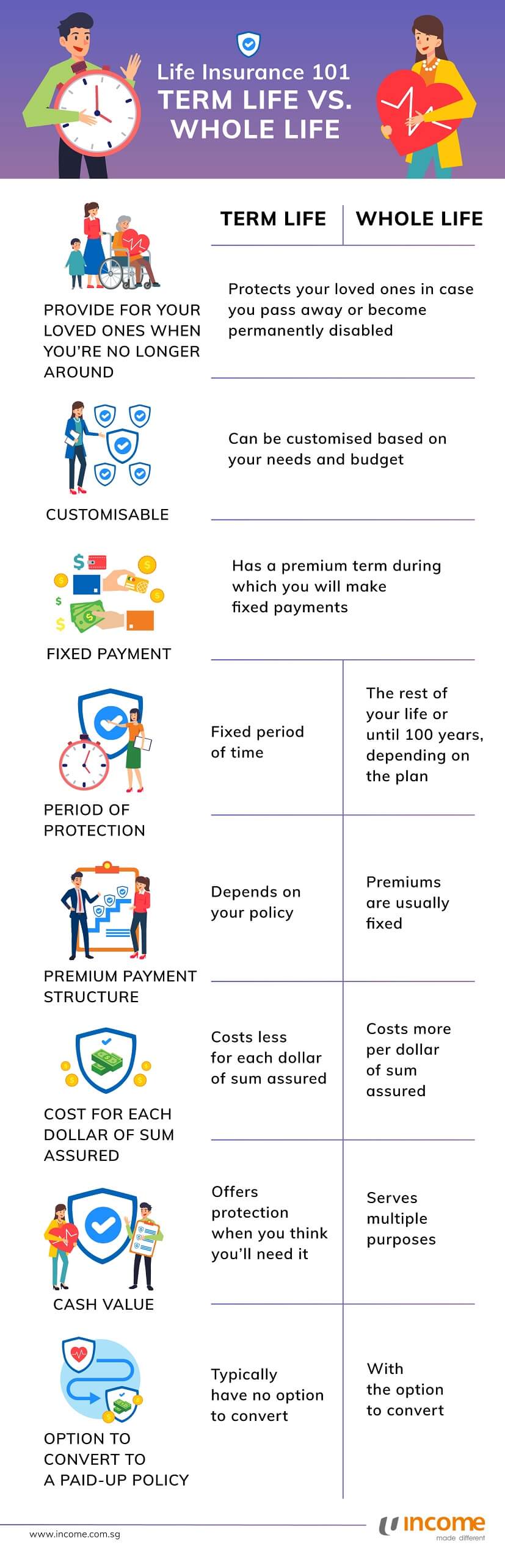

Whole Vs Term Life Insurance Ntuc Income

Sum Insured And Premium Different Words Don T Be Confused

Online Premium Payment Of Mahalaxmilife Insurance Life Insurance Business Insurance Insurance Premium

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

Lic S Jeevan Lakshya Life Insurance Quotes Life Insurance Marketing Life Insurance Marketing Ideas

Mahalaxmi Double How To Plan Business Insurance Best Insurance

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premium Payable For Life Insurance Calculator Life Insurance For Seniors Term Insurance

You Have Heard About Life Insurance And You Know It S Important But What Does It Really Mean Let S Find Simplifying Life Life Insurance Social Security Card

What Is Sum Assured Max Life Insurance

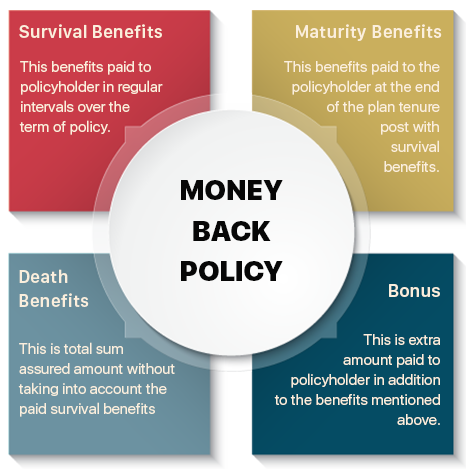

Money Back Policy Compare Money Back Plans Features Reviews

A Look At Premium Rates For Some Insurance Policies Of A Sum Assured Of 1 Crore Across Three Age Categories For Policy Terms How To Plan Term Insurance Policy

There Is A Minimum Sum Assured In Life Insurance Policies

Max Life Term Insurance Compare Best Plan Online Term Insurance How To Plan Best Insurance

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

What Is Sum Assured Max Life Insurance

Do You Ve A Lump On Your Neck Back Or Behind Your Ear This Is What It Means Buy Life Insurance Online Life Insurance Policy Life Insurance Calculator

Sum Assured Meaning What Is Sum Assured In Insurance Icici Prulife

What Is Sum Assured Max Life Insurance

Lic Help Blog Get Up To 100 Of Maturity Sum Assured After 5 Years Of Premium Payment Flexibility Of Liquidation As Profitable Business How To Plan Insurance

Posting Komentar untuk "What Is Means By Sum Assured In Life Insurance"