New India Assurance Mediclaim Top Up Premium Chart

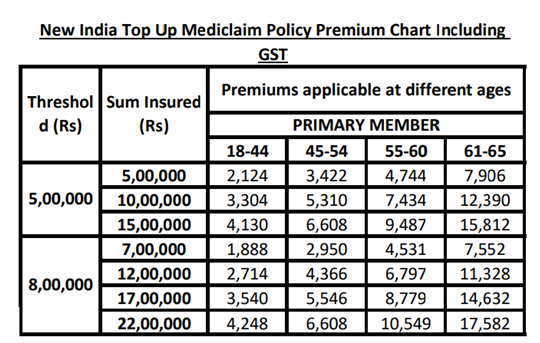

New India Assurance Top Up Mediclaim Premium Calculator. Minimum age- 18 years Maximum age - 60 years.

New India Floater Mediclaim Features Benefits Review

Royal Sundaram Mediclaim Policy.

New india assurance mediclaim top up premium chart. Go to the official website of the New India Assurance. Corporate Social Responsibility CSR Downloads. Posted by LH at.

The only difference is the cost of deductibles that make these plans easy-on pocket. Ltd India for Individual Mediclaim. Click on the Get Quote.

New India Assurance Health Insurance. The Oriental Insurance Co. We offer 10 Digital discount for our Customers on first time purchase of our selective products Private Car Two Wheeler Personal Accident House Holder Individual Personal Accident New Family Floater 2012 New India Floater Mediclaim New India Top Up Mediclaim Asha Kiran New.

New India Assurance Health Insurance Premium Calculator. FAQs on Policy by SMS. National Insurance Mediclaim Policy Premium Calculator.

You can calculate the premium using New India Assurance Top Up Mediclaim Premium calculator. Become an UIIC Agent. This policy is offered on a floater or individual basis and will cover up to 6 family members.

Specimen premium rates for individual health insuramce company. A person beyond the age 60 years can continue the plan provided heshe is insured under Mediclaim policy with New India Assurance without any break. New India Top-Up Mediclaim including In-Patient hospitalization expenses incurred within the country.

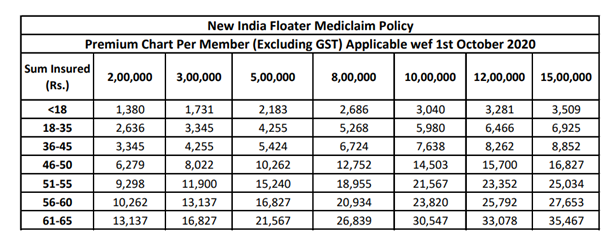

MATERNITY EXPENSES BENEFIT OPTIONAL COVER II. New India Floater Mediclaim Policy Premium Chart Excluding GST New India Floater Mediclaim Policy Premium Chart PREMIUM PER MEMBER Including GST OPTIONAL COVER I. Buy or renew insurance online.

New India Assurance Mediclaim Policy. New India launches new mediclaim policy Mediclaim 2012 with offering higher sum insured upto Rs 8 lakhs for existing and new customers. The health insurance premium calculator lets you calculate this premium amount on the basis of your insurance.

The policy covers in-patient hospitalisation expenses incurred within India. Available for a policy period of one year the Top-Up plan comes with a sum insured range that lies between Rs. New India has designed a simple buying process to avail of its health insurance plans.

New India Top-up Mediclaim Policy. New India Assurance operates both in India and foreign countries. PROPOSAL FORM OF NEW INDIA TOP UP MEDICLAIM POLICY Please read the prospectus before filling up this form.

This chart gives the premium rates for Mediclaim In India. It can be taken along with another health insurance policy. Oriental Individual Mediclaim Plan.

Board Approved Policy on Prevention Prohibition and Redressal of Sexual Harassment of Women at Workplace. 9422421700 or mail. Raheja QuBE Mediclaim Policy.

However the plan can also be bought without a base health plan. Strong domestic and international presence a wide range in insurance plans effective and advanced technology. Premium Chart for New India Assurance Co.

FAQs on COVID-19 Claims. Best View at 1024x768 Resolution. The New India Assurance Co.

Coverage can be availed on both individual and family floater basis. Features of New India Top-Up Mediclaim. Reliance HealthWise Mediclaim Policy.

It is a Family Floater plan. Oriental Insurance Premium Chart Premium Rates Premium various companies products in India - Delhi Mumbai Chennai Kolkata Pune. New India Health Insurance offers a top-up health insurance policy named New India Top-Up Mediclaim Policy.

Personal details Number of members Policy period Age and Sum assured and other details are required to calculate the premium. New India Assurance Top Up Mediclaim Insurance Policy - Find New India Assurance Top Up Mediclaim Insurance Policys policy details premium chart policy review and policy benefits for tax payers. Also after shortlisting the plan you can calculate the premium for family or individual health insurance plans offered by the company by following easy steps.

Portability of Health Insurance Policy started on Oct 12011. Choose two or more health insurance policies to compare and pick out the best one using the mediclaim premium calculator. New India Top-up Mediclaim is an excellent complimentary plan which can be availed along with your base health insurance plan.

The premium that you pay for a top-up health insurance policy is subject to tax deductions under Section 80D of the Income Tax Act 1961. Basically top-up health insurance is like an indemnity plan which provides the same benefits as a basic reimbursement health insurance plan. The Company shall not be on risk until the proposal has been accepted by the Company and communications of acceptance has been given to the proposer in.

NO PROPORTIONATE DEDUCTION OPTIONAL COVER III. 5 Lakh to Rs. The New India Assurance Co.

7300 Up to 75 years. New India Assurance Company Limited is a wholly owned subsidiary of Indian Government and is an multinational insurance contributor present in 27 countries and a market leader in the non life insurance sector in India based from Mumbai. Om Plaza 4307 1st Floor Sant Nagar East of Kailash New Delhi-65.

REVISION IN LIMIT OF CATARACT OPTIONAL COVER II. Product can be chosen to have either Third Party Liability or Bundled Package or Enhancement Policies. For Any queries or To Buy Medcialim call.

Star Health Mediclaim. These rates are applicable all over India. Moreover in a top-up plan pre-medical.

Premium for a person aged 69 for SI of 2200000 will be 7450 base premium of 61-65 7450 254 8195 800000 Threshol d Rs Premiums applicable at different ages ADDITIONAL MEMBER 500000 800000 New India Top Up Mediclaim Policy Premium Chart Including GST Threshol d Rs Sum Insured Rs Premiums applicable at different ages. MATERNITY EXPENSES BENEFIT Once the. Largest public sector general insurance company of India.

Health insurance premiums can be defined as the sum that you have to pay periodically to the insurer so that you can avail of the medical coverage for a particular time period. New India Top-Up Mediclaim is easily available on individual or floater sum insured basis covering up to 6 members including self legal spouse dependent children and dependent parents. Key features of New India Floater Mediclaim Policy.

Opt for Top-up Health Plans- To enhance the coverage benefits you can buy a top-up health plan alongside your existing mediclaim policy. For Comparative Insurance Quote. New India Assurance offers a variety of health insurance plans which the policyholders can customise on the basis of tenure and sum insured.

Select the Health Insurance tab choose the plan and click on Buy Online.

The New India Assurance Portal Office Home Facebook

Family Floater Health Insurance New India Assurance Premium Chestfamily

New India Assurance Overseas Mediclaim Insurance Policy Policy Details Premium Chart And Benefits Lic

Top 6 Best Health Insurance Plans For Senior Citizens Or Elderly Parents In India In

Best Family Floater Health Insurance Plans In India 2020 21

Choosing Health Insurance Plan From New India Assurance

Choosing Health Insurance Plan From New India Assurance

Best Super Top Up Health Insurance Plans In India Comparison Moneychai

Is New India Assurance Top Up Policy The Cheapest

The New India Assurance Co Ltd New India Floater Mediclaim Policy Prospectus Pdf Free Download

Family Floater Health Insurance New India Assurance Premium Chestfamily

New India Assurance Company Renew Or Buy Policy Online

New India Health Insurance Top Up Plans 2020 Online In India

Top 6 Best Health Insurance Plans For Senior Citizens Or Elderly Parents In India In

New India Assurance Overseas Mediclaim Insurance Policy Policy Details Premium Chart And Benefits Lic

New India Assurance Family Floater Mediclaim Policy Plans Reviews

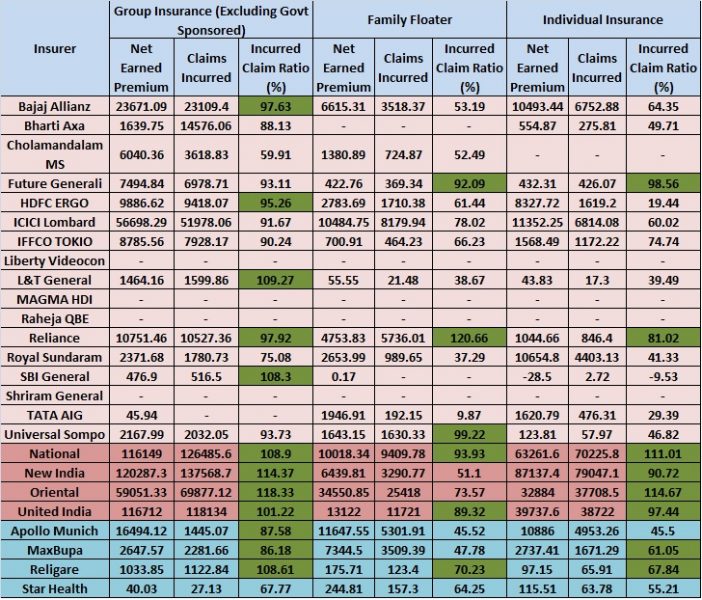

Best Health Insurance Companies In India Based On Irda Data

Posting Komentar untuk "New India Assurance Mediclaim Top Up Premium Chart"