New India Assurance Super Top Up Plan

HDFC Ergo Health Suraksha offering to bank and credit customers currently Let me give you a comparison chart of the current Top up health insurance plans in India at the moment. Your health insurance will pay Rs 5 lakh from 1st claim and remaining Rs 2 lakh to be covered under the Top-up Plan for the 1st claim.

Top 5 Best Health Insurance Plans In India 2020 Basunivesh

Features of New India Top-Up Mediclaim.

New india assurance super top up plan. Companies offering Super Top up United India. Aggregate deductible options available include 345 lakhs. While it is a decent top up plan it doesnt offer a disproprotionately large cover as the plan only allows you to pick a maximum cover of 22 lakhs.

This creates easy claim processing. New India Top-Up Mediclaim is easily available on individual or floater sum insured basis covering up to 6 members including self legal spouse dependent children and dependent parents. You can get a sum assured of 25 Lakhs with 5 Lakhs deductible by paying a premium of Rs.

Your health plan will cover Rs 4 Lakh and Rs 1 lakh for the second claim. Sum assured options available include 5671015202550 lakhs. The policy covers in-patient hospitalisation expenses incurred within India.

ICICI Lombard Top up Plan Health Care Plus Insurance Plan New India Assurances Top Up Mediclaim Policy. Aggregate deductible options available includes 3510 Lakhs. Our Extra Care Plus plan a top-up health cover provides an add-on cover to your existing health insurance policy It acts like a stepney to your health insurance policy after you use up your sum insured limit.

New India Assurance operates both in India and foreign countries. Top 5 Super Top-up Health Insurance Plans in India 2020. Super top-up plans are similar to top-up plans except that top-up plan covers a single claim above the threshold limit while the super top-up plan covers the total of all hospitalization bills above the.

The NIA top-up plan is not the cheapest and it is more expensive than super top-up products which are a better option. 10 lacs 37 or 7 lacs 34. Super Top up Cover for Employees having.

The name of ICICI Lombards Super Top-up plan is Health Booster. 6 For higher age person above 55 years of age it is very difficult to increase the sum insured under your mediclaim policy hence super top up policy is advisable where you can top up your mediclaim sum insured by. More importantly in our opinion it is never a good idea to buy a top up policy in the first place.

Super Top Up Plan By New India Assurance. The policy responds only when the aggregate of all hospitalisation expenses of one or all the members exceeds the threshold limit known as deductible as stated in the policy. Always choose a super to up plan and if.

In the event of a claim of Rs 7 lakh and Rs 4 lakh. This policy is offered on a floater or individual basis and will cover up to 6 family members. Top-up health insurance plans cover policies that offer an additional coverage beyond the threshold limit of the existing health insurance policy.

Available for a policy period of one year the Top-Up plan comes with a sum insured range that lies between Rs. There are 3 options that are currently available A B and C. New india assurance super top up plan.

Experts typically suggest that you must buy a super top-uptop-up plan with a deductible equal to the sum assured under your base health policy. New India Top-Up Mediclaim is easily available on individual or floater sum insured basis covering up to 6 members including self legal spouse dependent children and dependent parents. The best strategy while choosing the Top 5 Super Top-up Health Insurance Plans in India 2020 is to have both the base plan and super top-up plans within the same company.

Buy or renew insurance online. Detail of New India Top-Up Mediclaim Policy benefits features premium details also compare similar plans of other companies Buy online. These are situations in which a Super Top-Up Plan can help.

Product can be chosen to have either Third Party Liability or Bundled Package or Enhancement Policies. Simply put once you spend your deductible limit all extra medical expenses during the whole year are paid by New India. This is because when any claim arises you can use your existing base health policy to pay medical bills up to the deductible and then make a claim using the super top-uptop-up plan for the remaining amount.

Sum Assured available under Gold Plan includes 510152025 Lakhs. It can be taken along with another health insurance policy. New India Health Insurance offers a top-up health insurance policy named New India Top-Up Mediclaim Policy.

5 Lakh to Rs. Our Extra Care Plus is the top-up health protection your existing health cover needs. A super top-up plan.

This means total insurance cover is Rs. People are being more risk-averse about their own health and have started preparing a backup plan for everything and when it comes. Annual premium including taxes for Lifetime Health India Plan for sum insured of 50 lakhs is 12899- for the individual insured.

This means the entire cost is not borne by your super top-up health insurer but only a part of is it covered based on what your deductible is. 5 Super Top Up plan is cheapest super top up plan available in the market. The remaining Rs 3 Lakh will be covered under the Super top-up health plan.

Super Top Up Health Insurance plan increases your health cover up to 30 lacs of your existing health insurance policy at. New India Top-Up Mediclaim including In-Patient hospitalization expenses incurred within the country. Gold This is a Super Top-up plan Option.

A super top-up plan works on a cost-sharing basis. If your super top-up plan has a deductible of Rs 2 lakhs then your super top-up plan will cover for claims beyond 2 lakhs. Largest public sector general insurance company of India.

Top-up Plan Super Top-up Plan. United India has a super top-up plan Insurance cover 7 lacs and threshold limit 3 lacs. Not many Super top up plans so they are not in the chart while comparing.

In adherence with the new guidelines and growing need of health. For example your present health plan has a deductible limit of Rs 5 lakhs and you are billed Rs 6 laks in some surgery. The need of the hour The perception towards life and health insurance has changed due to Covid-19.

We offer 10 Digital discount for our Customers on first time purchase of our selective products Private Car Two Wheeler Personal Accident House Holder Individual Personal Accident New Family Floater 2012 New India Floater Mediclaim New India Top Up Mediclaim Asha Kiran New.

New India Assurance Health Insurance Premium Calculator Chart 2021

New India Assurance Two Wheeler Insurance Renewal Online Payment

New India Assurance Two Wheeler Insurance Renewal Online Payment

The New India Assurance India S Premier Multinational General Insurance Company

The New India Assurance India S Premier Multinational General Insurance Company

India Claim Form Fill Out And Sign Printable Pdf Template Signnow

Cosh Best Orthopedic Multi Specialty Hospital In Tambaram Chennai India 24 7 Emergency Ambulance With Ventilator Services Best Ortho Hospital In Chennai

Private Sector Car Insurers Vs Public Sector Car Insurers Private Insurance Insurance Company Insurance

Best Home Insurance Plans In India 2020 21 Home Insurance How To Plan Best Home Plans

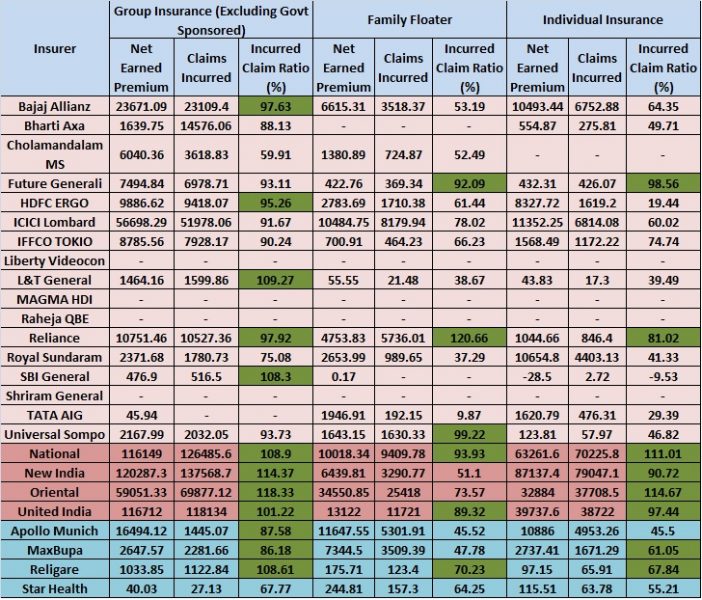

Best Health Insurance Companies In India Based On Irda Data

New India Health Insurance Top Up Plans 2020 Online In India

New India Health Insurance Top Up Plans 2020 Online In India

New India Health Insurance Top Up Plans 2020 Online In India

The New India Assurance India S Premier Multinational General Insurance Company

Hdfc Ergo My Health Medisure Super Top Up Plan Indicative Premium Quotes Health Insurance Plans How To Plan Best Health Insurance

Health Insurance Expert Salasar In 2021 Health Health Care Insurance

Posting Komentar untuk "New India Assurance Super Top Up Plan"