Maturity Sum Assured In Jeevan Saral

Jeevan Saral calculator maturity benefit. Jeevan Saral 165 Loyalty Addition for 2018-19.

Lic Jeevan Saral Plan 165 Premium Maturity And Benefits Calculator Insurance Funda

Maturity claim for term assurance rider is not payable.

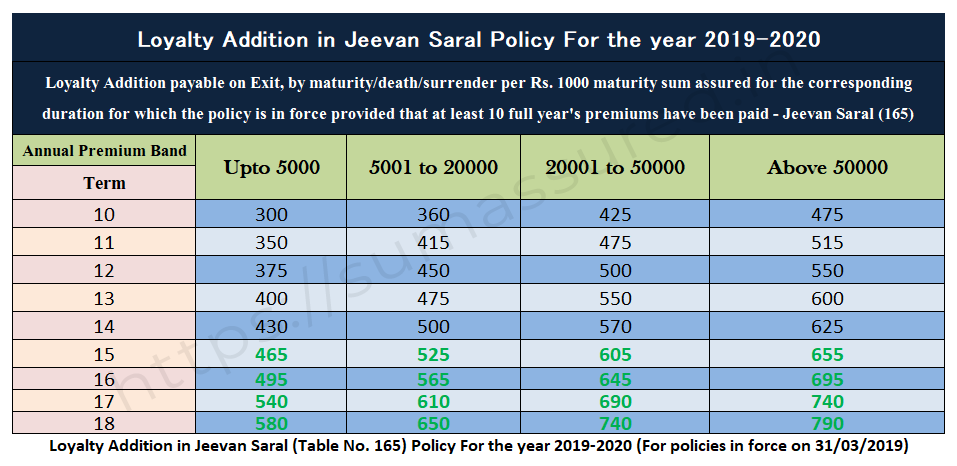

Maturity sum assured in jeevan saral. This Loyalty Addtion is based on yearly premium bands and policy term. The policyholder can choose the premium amount and Maturity Sum Assured as well as Death Sum Assured is subsequently determined based on the premium selected by him. LIC Jeevan Saral in Hindi LIC Jeevan Saral Plan Details - Table No.

This plan offers Double Death Benefit of Sum Assured Return of Premium. Also refer premium of your policy and calculated. You need to provide these details in the Lic Maturity Value Calculator along with Name Mobile number Email ID to calculate the maturity value in an easy way.

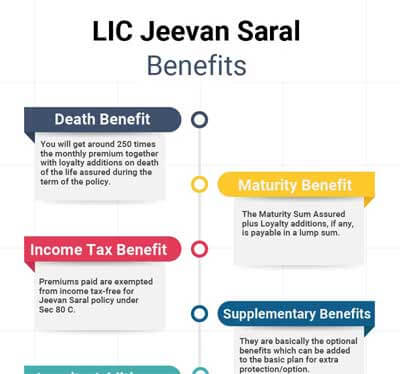

The maturity sum assured which was paid to him after 12 years was a mere Rs24575 plus bonus amounting to Rs34405. The only difference is that the profit earned in other policies of LIC is distributed to all policy holder but in JEEVAN SA. The Maturity Sum Assured plus Loyalty additions if any is payable in a lump sum.

Lic Maturity Amount Calculator provides maturity amount based on Age of the policyholder Policy term Policy name Sum Assured etc. It is an endowment policy available only. Find here the simple online calculator to calculate the benefits of the Jeevan Saral Policy which is an LIC policy.

LICs Jeevan Saral Plan 165 Key features. A lump sum amount is paid to the family of the policyholder as long as the policy term continues in case of an unfortunate life assureds deathThis includes 250 times the premium paid every month along with loyalty additions if any and premium returns. And they have highlighted many such cases in their other articles.

Death coverage shall be the sum of 250 times the monthly basic premium Death Sum Assured Premium paid excluding the first year. Why did this happen. LICs Jeevan Saral is one of the best policy in Indian insurance industry.

165 LIC Jeevan Saral is actually an endowment policy with a lot of flexibilities that is usually available only with unit linked insurance plans. The death benefit under the plan is calculated using the following formula-Death benefit 250 monthly premium paid Loyalty Additions paid on death. The maturity sum assured is calculated based on your entry age and the premium that you have paid.

This is a participatory profit policy like any other with profit policy of LIC. Home Products Withdrawn Plans LICs Jeevan Saral Plan No. Hi Saurav I have taken the Jeevan Saral Policy 3 years ago and pay a monthly installment of 5104 for a term period of 16 years.

To calculate loyalty addition in your policy refer your policy bond to know the Maturity Sum Assured. Read complete details of Jeevan Saral Plan. Jeevan Saral Policy Benefits.

This policy gives you flexibility of liquidation at no additional charges after 10 year. Jeevan Saral calculator maturity benefit. Maturity Sum assured which is also printed on the policy bond while issuing the policy.

How to Calculate Loyalty addition and Maturity in LIC Jeevan Saral Plan no 165. Maturity claim Maturity sum assured not death sum assured loyalty addition. 165 Features Date of Withdrawal.

Premium is chosen by the policyholder and Sum Assured is 250 times the Monthly Premium amount. Death benefit 250 monthly premium paid Loyalty Additions paid on death. Maturity Return - Maturity Sum Assured Premiums paid with Loyalty Addition will be paid on Policy maturity.

Hence it is categorized under Special Plans. The maturity sum assured is calculated based on your entry age and the premium that you have paid. Policy maturity amount is the sum assured amount with loyalty additional.

The agent assured me a guaranteed amount of 23 lakh however the Maturity Sum assured Death Benefit Sum Assured Accidental Benefit Sum Assured Term Rider Sum Assured is 1060050 1250000 1250000. LIC Jeevan Saral Benefits. Jeevan Saral 165 Loyalty Addition is available along with Maturity Sum Assured MSA on Death Surreder or Maturity provided premiums for atleast 10 years have paid.

Death Benefit On the death of the life insured before policy maturity Sum assured with Loyalty Addition will be paid. Any Time Maturity ATM Plan The LIC Jeevan Saral Policy allows life insured to withdraw partialfull maturity after 10. Premiums paid are exempted from income tax-free for Jeevan Saral policy under Sec 80 C.

LIC Jeevan Saral 165 Plan LIC Jeevan Saral Policy Table 165 plan is an ATM plan. 37 rows LIC Jeevan Saral plan is also known as atm plan. The death benefit under the plan is calculated using the following formula-.

LIC Jeevan Saral Plan 165 Key features. Under Jeevan Saral the Sum Assured is a multiple of your monthly premium. Benefits of LIC Jeevan Saral.

If life assured is surviving on date of maturity and also if all premiums have been paid during policy term then. Jeevan Saral calculator death benefit. The Maturity Sum Assured depends on the age at entry of the life to be assured and is payable on survival to the end of the policy term.

Death Sum assured which is 250 times the monthly premium excluding rider premium if any. Lic Jeevan saral Policy Maturity claims. MSA Maturity Sum assured printed on the LIC Jeevan Saral Policy bond.

How is maturity benefit calculated for LIC Jeevan Saral. Death coverage shall be the sum of 250 times the monthly basic premium Death Sum Assured Premium paid excluding the first year premium and rider premiums Loyalty. The LIC Jeevan Saral Policy is an endowment plan which is non-unit linked insurance plan policy under LIC Life Insurance Corporation of India with Double DeathBenefit of Sum Assured Return of Premium.

It also offers the flexibility of term and a lot of liquidity. Jeevan Saral calculator death benefit. Answer 1 of 2.

In the case of policyholders death within the policy tenure the complete benefits will go to the nominee including the assured sum amount and return of premiums excluding rider premium and first-year premium amount and additional loyalty amountif any. The policyholder can choose his own premium amount and Maturity Sum Assured as well as Death Sum Assured is subsequently determined based on the premium paid by him. Here the Maturity Sum Assured would be re-evaluated under the policy norms to be the Sum Assured corresponding to the duration of premiums paid.

LIC Jeevan Saral Plan 165 can make your life even simpler if the policy holder dies due to any reason within the Jeevan Saral policy he will be given a death benefit. View Jeevan Saral Maturity benefits SUM assured Loan Surrender value and Tax benefits details. Income Tax Benefit Available under Section 80 C for premiums paid and Section 10 10D for Maturity returns.

The maturity proceeds of Jeevan Saral are also exempted from tax under Section 10 10D. There are two types of Sum Assured in Jeevan Saral a Death Sum Assured b Maturity Sum Assured.

Lic Jeevan Saral Plan 165 Compare Reviews Features And Benefits

Life Insurance Endowment Plan Return Calculation Using Ms Excel

Lic Jeevan Sugam Life Insurance Marketing Ideas Life Insurance Corporation Life Insurance Marketing

Lic India Jeevan Saral Jeevan Anand Lic Jeevan Saral Table No 165 Save Words Word Search Puzzle

Lic Help Blog Get Up To 100 Of Maturity Sum Assured After 5 Years Of Premium Payment Flexibility Of Liquidation As Profitable Business How To Plan Insurance

Lic Jeevan Saral Plan 165 Details Calculators Review And Illustrations Insurance Funda

Lic Jeevan Saral Policy 165 Features Benefits Eligibility

Practice Latest Ic38 Mock Test For Lic Agency Exam

Lic Jeevan Saral Plan Review Key Features Benefits

Lic Jeevan Saral Plan 165 Premium Maturity And Benefits Calculator Insurance Funda

Lic Jeevan Saral Plan No 165 Returns Unbounded

Loyalty Addition In Jeevan Saral Policy Sum Assured

Lic New Plan 2014 New Jeevan Anand How To Plan Anand Let It Be

Lic Jeevan Saral Chart Pdf Download Atm Plan 165

Want To Know The Important Things About Saral Jeevan Bima Read Here In 2021 Term Life Life Insurance Policy Term Life Insurance

Lic S Jeevan Saral Why So Much Confusion

Lic Jeevan Saral Plan 165 Compare Reviews Features And Benefits

New Jeevan Anand In 2021 How To Plan Life Insurance Marketing Life Insurance Agent

Lic Saral Jeevan Bima Plan No 859 Term Life Insurance Basunivesh

Posting Komentar untuk "Maturity Sum Assured In Jeevan Saral"